What is a chargeback?

Chargebacks are transactions that have been disputed by the payment cardholder. They are a form of customer protection provided by the issuing banks, which allows cardholders to file a complaint regarding fraudulent transactions on their statement. Once the cardholder files a dispute, the issuing bank makes an investigation into the complaint. Cardholders may dispute a transaction when they don't recognize the charge on their statement, the purchase received by the cardholder may not match what was advertised, or the services/items that were purchased were not received by the cardholder, etc.

If a purchaser files a chargeback, you will be notified by email. Pay particular attention to the chargeback type. You can then make your decision whether which of these options to take:

- Concede - this will allow the customer to receive a full refund

- Challenge - this means you don't think the customer should receive a refund and you will provide supporting evidence

Your chargeback notification email will include a link to a form to fill out. Complete the form within 3 days of notification.

If the payment was created prior to August 6, 2024, you will be notified by email from WePay. The following information pertains to chargebacks from WePay.

- WePay is notified about the chargeback by the cardholder’s bank

- WePay automatically debits the funds from your WePay account to cover the chargeback cost, and they notify you about the chargeback. WePay will then provide you with information and guidance to keep you informed on the status of your chargeback via email.

- There may be a $15 non-refundable fee for the chargeback that is assessed when the chargeback is originally filed; this will be withdrawn from your WePay account, or your bank account if the funds are not available in your merchant account.

What are my options when dealing with a chargeback?

As the transaction merchant, you can either concede or challenge the chargeback. You have 5 days to respond to the initial chargeback notification. Should you ignore the request, WePay may automatically decide in favor of the cardholder.

- If you concede the chargeback, you are accepting responsibility and the chargeback is resolved in favor of the cardholder, meaning the funds that were debited from your WePay account are returned to the cardholder and the chargeback is complete

- If you challenge the chargeback, you must provide supporting evidence (see the next section on chargeback types and documentation evidence).

- WePay submits the supporting evidence to the credit card network (e.g. Visa, Mastercard, Discover, etc.) for their decision on the chargeback.

- If the credit card network rules in the cardholder’s favor, the funds are not returned to your WePay account

- If the credit card network rules in your favor, the funds are debited back to your WePay account

- In both scenarios, WePay will notify you of the credit card network’s decision

- WePay submits the supporting evidence to the credit card network (e.g. Visa, Mastercard, Discover, etc.) for their decision on the chargeback.

What should I do if I receive a chargeback?

If you are notified of a chargeback you should review the information carefully, paying particular attention to the chargeback type. You can then make your decision whether to concede or contest the chargeback.

Concede:

- Click the Concede button in the chargeback email notification you received from WePay, OR

- Log into your WePay merchant portal

- Click the Reporting tab

- Click the Chargebacks tab

- Click Concede

- Click Yes, I want to concede to confirm

Challenge:

- Gather the appropriate supporting evidence (see the next section on chargeback types and documentation evidence).

- Contact the purchaser/cardholder to help them understand what the charge was for and/or what cancellation policy applies to them.

- Click the Challenge button in the chargeback email notification you received from WePay, OR

- Log into your WePay merchant portal

- Click the Reporting tab

- Click the Chargebacks tab

- Click Challenge

- Select the payment type, enter the payment date, upload your supporting documentation, and enter any additional details as needed

- Click Submit

What are the chargeback types and required documentation evidence for each?

The most common chargebacks experienced on ActivityHero are:

Charge not Recognized by Cardholder

Contacting the purchaser and reminding them about their registration will often clear up the issue. The charge appears as "WPY*YOUR BUSINESS NAME" on the cardholder's statement. If the chargeback was a mistake, ask the purchaser to contact their credit card company to reverse the chargeback. Include the date/time of your calls and/or emails as evidence that the cardholder made a mistake.

Credit Not Processed

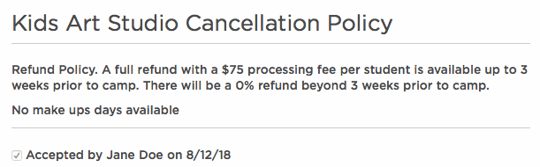

If the cardholder is expecting a refund that is different than what your written policies allow, remind the cardholder of the cancellation terms they saw at the time of payment (they can be viewed on their My Registrations page).

You need to supply documentation showing that the cardholder was aware of and agreed to your policy. This can be done by including a screenshot like the one below that includes your written cancellation/refund policy and the date that the cardholder agreed to the terms. You can find this screen when you click on the child's name on your Registration Reports in ActivityHero.

For additional information, please go to WePay's help center: Documentation Needed Based on Chargeback Type and Sample Evidence.

For two chargeback types - recognition chargebacks and refunds, WePay will contest automatically and additional documentation is not needed. If either of these scenarios occurs, you will be notified via e-mail, but you will not need to take any action.

How many days do I have to submit my evidence?

From the day that you receive your first chargeback notification, you will have 5 business days to submit your evidence. This window ensures that WePay has sufficient time to represent the evidence to the cardholder’s bank and/or card network within their allocated timeframes. Late submissions of evidence will be evaluated on a case-by-case basis and submitted accordingly.

What file formats do I need to use for my document evidence?

Currently, WePay accepts JPG, JPEG, TIF, TIFF, PNG, and PDF files. Please keep in mind that there are size limitations on files, so you may want to submit screenshots if necessary. For instance, if you would like to submit your refund policy but the file size is too large, you can take a screenshot of the page.

I have submitted all my documents, when will I know the status of the chargeback? And where can I see my status?

Your merchant portal will provide you with the latest information on your chargeback status. You will receive e-mail notifications regarding your chargeback as well. Once you receive notification about a chargeback, it will take approximately 20 days for AMEX to resolve the chargeback, and 45 days for all other card networks to resolve.

How long does it usually take to resolve a contested chargeback?

Due to timelines for card networks and issuing banks, the chargeback can take up to 45 days to be resolved.

What can I do to avoid chargebacks?

You'll want to make sure that your fees and any additional items your participants are going to be paying for have clear descriptions and pricing, as well as any additional details that will ensure the participant has a clear expectation for the service that they will be receiving.

Make sure that your cancellation and refund policy is very clear about whether you offer full or partial refunds. The cancellation policy that was in effect at the time that the purchase was made can be viewed with the registration details. When a purchaser asks about a refund, be sure to reference the specific cancellation policy, which the purchaser can view on their My Registrations page.

You should also keep records to show the participant attended or participated in the session. This could be a sign-in sheet that shows the participant's name and attendance record.

I already issued a refund for this transaction, why did I still get a chargeback?

You can receive a chargeback up to 120 days after the original transaction. Cardholders tend to reach out to both the merchant and their bank to receive the disputed funds. Sometimes the bank still issues a chargeback - even after you provide a refund - since the bank is not aware of this refund. If this happens, we encourage you to challenge the chargeback and provide evidence about the refund being issued.

Once a chargeback has been resolved in my favor, can it be resubmitted by the cardholder?

If you win the chargeback, the cardholder is still able to chargeback the transaction once again. This occurrence takes various names depending on the card network. Visa refers to it as pre-arbitration, while MasterCard calls it a 2nd chargeback. The entire chargeback process begins again with the filing of a second chargeback. Once the process finishes, the issuing bank determines whether to rule in favor for you or the customer once again, and it won't necessarily come to the same determination as the first decision.

There’s still one more opportunity for the issuing bank to dispute the transaction if the issuing bank sides with the merchant in the event of pre-arbitration/second chargeback. The issuing bank can push the dispute to arbitration, automatically charging a $250 fee to the merchant. If the merchant wins arbitration, the issuing bank returns the $250 fee. If the merchant loses, they’re assessed an additional $250 fee.